Return on capital

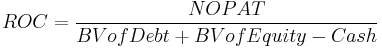

Return on capital (ROC) is a ratio used in finance, valuation, and accounting. The ratio is estimated by dividing the after-tax operating income (NOPAT) by the book value of invested capital.

Contents |

Formula

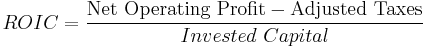

This differs from ROIC. Return on invested capital (ROIC) is a financial measure that quantifies how well a company generates cash flow relative to the capital it has invested in its business. It is defined as net operating profit less adjusted taxes divided by invested capital and is usually expressed as a percentage. In this calculation, capital invested includes all monetary capital invested: long-term debt, common and preferred shares.

When the return on capital is greater than the cost of capital (usually measured as the weighted average cost of capital), the company is creating value; when it is less than the cost of capital, value is destroyed.

ROIC formula

Note that the numerator in the ROIC fraction does not subtract interest expense, because denominator includes debt capital.

See also

- Cash flow return on investment (CFROI)

- Profitability

- Rate of profit

- Rate of return on a portfolio

- Profit maximization

- Tendency of the rate of profit to fall

- Return on investment (ROI)

- Return on net assets (RONA)

- Return on revenue (ROR), also Return on sales (ROS)

- Risk adjusted return on capital (RAROC)